January 29, 2026 | 11:34 am

TEMPO.CO, Jakarta - The U.S. Federal Reserve on Wednesday announced that it will keep interest rates unchanged.

The central bank will keep the target range for the federal funds rate between 3.5 and 3.75 percent. The Fed had lowered rates three times last year.

"Available indicators suggest that economic activity has been expanding at a solid pace," the bank said in a statement. "Job gains have remained low, and the unemployment rate has shown sign of stabilization. Inflation remains somewhat elevated."

Ten of the 12 members of the Federal Open Market Committee voted for the policy, with two dissenting. Fed Governors Stephen Miran and Christopher Waller, both appointed by U.S. President Donald Trump, were in favor of a quarter-point rate reduction.

Federal Reserve Chair Jerome Powell was one of the 10 members who voted in favor of keeping the rates as they are.

To boost the economy, the Federal Reserve will lower interest rates to stimulate borrowing. During times of high inflation, as seen in recent years, the Fed will often raise rates to keep the economy from overheating.

Latest decision comes amid criminal investigation

Trump, in recent years, has frequently chided Powell for not lowering rates, calling him "too late."

U.S. Attorney for the District of Columbia and Trump ally Jeanine Pirro has launched a criminal investigation into Powell regarding the renovations of historic buildings. Powell said the probe was political pressure to influence the Fed on monetary policy.

Powell's term as chair ends in 2026. Trump is then expected to nominate Powell's successor for the role.

Trump has also attempted to fire Lisa Cook, a Fed governor who had been nominated by Trump's predecessor, Democratic President Joe Biden. Cook has challenged her dismissal and her case is being deliberated by the U.S. Supreme Court.

The Fed is independent from the administration in power and does not have to abide by the president's demands. Powell said he believes the bank will keep its independence, as it "has served the people well."

Read: Bank Indonesia Holds Interest Rate at 4.75% as Rupiah Tumbles

Click here to get the latest news updates from Tempo on Google News

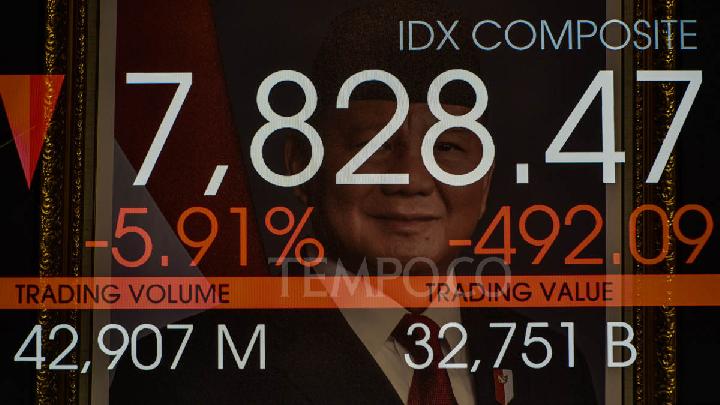

IHSG Slides 1.24%, Industrial Sector Hit Hardest

7 hari lalu

The IHSG's plunge this afternoon was a continuation of the weakening that occurred this morning.

Bank Indonesia Holds Interest Rate at 4.75% as Rupiah Tumbles

7 hari lalu

Bank Indonesia keeps the deposit facility interest rate at 3.75 percent and the lending facility interest rate at 5.50 percent.

IHSG Edges Up 11.19 Points to Close at 8,944.80

21 hari lalu

The IHSG ended higher at 8,944.80 on Jan 7, 2026, driven by expectations of a U.S. Fed rate cut.

3 Factors That Could Push Inflation Above 3% in the First Quarter

22 hari lalu

Permata Bank Chief Economist Josua Pardede predicts that inflation will remain above 3 percent throughout the first quarter of 2026.

Indonesian Rupiah Weakens to Rp16,788 per US Dollar Amid BI Rate Cut

30 hari lalu

Rupiah closed weaker, down 43 points or about 0.26 percent to Rp16,788 per U.S. dollar.

Rupiah Climbs to 16,663 per USD After Fed's Latest Rate Cut

49 hari lalu

Even so, the rupiah's upside remains limited by domestic concerns, especially the economic impact of the Sumatra floods.

Bank Indonesia Outlines Monetary Policy Direction for 2026

29 November 2025

This monetary policy direction is chosen amidst the ongoing global uncertainty.

Bank Indonesia Projects 5.33% Economic Growth for 2026

13 November 2025

Bank Indonesia (BI) has projected that Indonesia's economy will grow by 5.33 percent in 2026, slightly below the government's target of 5.4 percent.

Indonesia's Stock Index Closes Lower as Investors Await Fed's Year-End Policy Direction

10 November 2025

The Indonesia Composite Index (IHSG) of the Indonesia Stock Exchange (IDX) closed lower on Monday afternoon.

Analyst: Fed Rate Cut Likely to Have Only Short-Term Impact on Indonesia

31 Oktober 2025

Mirae Asset Indonesia believes that the Fed Rate cut could affect the Indonesia Composite Index (IHSG).