TEMPO.CO, Jakarta - The Jakarta Composite Index (IHSG) of the Indonesia Stock Exchange (IDX) closed down 88.35 points, or 1.06 percent, at 8,232.20. Meanwhile, the LQ45 index of leading stocks rose slightly by 0.47 points, or 0.06 percent, to 813.01.

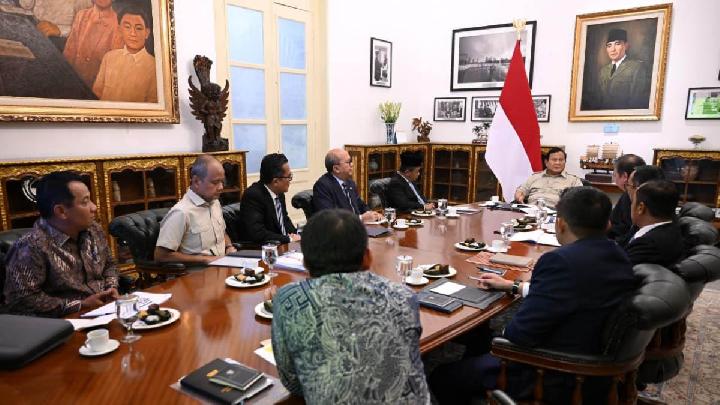

"After trading resumed, the IHSG initially faced a steeper decline, but subsequent bargain hunting helped narrow the losses," said Ratna Lim, Head of Research at Phintraco Sekuritas, in her analysis in Jakarta on Thursday, August 29, 2026, as quoted by Antara.

During today's session, the IHSG was hit with a trading halt at 09:26 JATS time after plunging 665.89 points, or 8.00 percent, to 7,654.66, before eventually staging a recovery.

In response to the Morgan Stanley Capital International (MSCI) announcement, the Financial Services Authority (OJK) and the IDX will issue a revision of minimum public share ownership, or free float, raising it from 7.5 percent to 15 percent in February 2026. This free float requirement will apply to both new and existing issuers.

If issuers fail to meet this new threshold, an exit policy will be implemented, though the specific details of that policy have not yet been confirmed.

The IDX and the Self-Regulatory Organization (SRO) will also adjust and submit proposals as requested by MSCI regarding the transparency of free float shares in Indonesia.

Furthermore, the OJK disclosed that the government will soon issue regulations concerning the demutualization of the Indonesian Stock Exchange, with a target release in the first quarter of 2026.

Additionally, authorities plan to provide Ultimate Beneficial Owner (UBO) data to MSCI, which will initially focus on the constituents of the IDX100.

After opening lower, the IHSG remained in negative territory through the end of the first trading session. In the second session, the index stayed in the red zone until the close of trading.

According to the IDX-IC Sectoral Index, only the transportation and logistics sector strengthened, rising by 0.36 percent.

Conversely, 10 sectors weakened, with the non-primary consumer goods sector recording the sharpest decline at 4.78 percent, followed by healthcare and property, which fell by 3.82 percent and 3.65 percent, respectively.

The stocks recording the largest gains were KIOS, ELIT, CUAN, FORE, and MEDS. On the other hand, the steepest declines were seen in GOLF, BUMI, VKTR, EXCL, and BUVA.

Trading frequency reached 4,934,519 transactions, with 99.10 billion shares traded at a total value of Rp68.17 trillion. There were 214 advancing stocks, 521 declining stocks, and 73 stocks that remained unchanged.

In the afternoon, regional Asian exchanges saw the Nikkei index rise by 53.60 points, or 0.10 percent, to 53,412.30, while the Shanghai index edged up 6.73 points, or 0.16 percent, to 4,157.97. The Hang Seng index climbed 141.17 points, or 0.51 percent, to 27,968.08, and the Straits Times index rose 20.68 points, or 0.42 percent, to 4,930.02.

Read: Goldman Sachs Downgrades Indonesian Stocks After MSCI Warning

Click here to get the latest news updates from Tempo on Google News