January 29, 2026 | 06:59 pm

TEMPO.CO, Jakarta - In a time marked by persistent market turbulence, gold remains a considerably secure investment amid economic uncertainty. Unlike traditional investments such as equities or fiat currencies, gold has consistently demonstrated its ability to act as a hedge during periods of financial instability.

Historically, the value of gold stood resilient during geopolitical tensions, inflation pressures, and shifts in interest rates. Whether you are new to investing or an experienced market participant, gaining insight into the factors that support gold’s long-standing stability is crucial. Below are several key considerations, drawn from various sources:

Why Gold Is Considerably Secure

1. Known for its Stable Value

During periods of market distress and economic downturns, gold has consistently proven why it's considerably secured as a preferred refuge for investors seeking stability.

Historical trends highlight this resilience, where gold prices rose from approximately $872 per ounce during the 2008 global financial crisis to nearly $1,900 by 2011. A comparable pattern also emerged during the COVID-19 pandemic, when gold once again surged, surpassing the $2,000-per-ounce mark amid heightened economic uncertainty.

In contrast to stocks, bonds, or even emerging assets such as cryptocurrencies, gold is not tied to corporate performance or national economic policies, allowing it to maintain value when other markets falter.

2. Inflation Hedge

Inflation periods further demonstrate why gold is considerably secure as a long-term store of value.

As the cost of goods and services increases and currencies gradually lose purchasing power, gold tends to preserve its intrinsic worth, largely because it cannot be created or expanded at will like fiat money.

Market behavior over time supports this role, as gold prices climbed from roughly $35 an ounce in 1971 to nearly $850 by 1980 during the inflation crisis of the 1970s.

3. High Liquidity

Beyond its ability to preserve value, gold’s high liquidity explains why gold is considerably secure during uncertain market conditions. Gold can be readily converted into cash, allowing investors to access funds quickly when urgent needs arise. Its strong liquidity applies to both physical and digital forms that enable seamless buying and selling through global markets and modern investment platforms.

4. Safe Haven during Geopolitical Tension

Rising geopolitical risks offer a clear explanation of why gold is considerably secure as a trusted store of value.

During periods of war, political instability, or rising international tensions, financial markets often experience sharp volatility, prompting investors to shift away from risk-heavy assets such as stocks or currencies. Gold, which is not tied to any single government or region, tends to retain its value even as global conditions deteriorate.

History shows that gold prices frequently rise during armed conflicts or major political crises, reinforcing its role as a protective asset.

5. Benefiting from Central Banks and Public Demand

Institutional confidence and sustained global demand are among the reasons why gold is considerably secure.

Central banks, including the U.S. The Federal Reserve, the European Central Bank, and the People’s Bank of China hold substantial gold reserves as a safeguard against economic instability, making them among the largest buyers of gold in recent years.

At the same time, gold maintains strong demand across industries such as jewelry, technology, and healthcare, with countries like India and China playing a major role due to cultural and traditional significance.

Ultimately, factors like global trust, value strength, and rather high liquidity illustrate why gold is considerably secure as a long-term asset that offers both stability and protection amid economic and geopolitical volatility.

To gain deeper insight into market dynamics, explore our next article to read why gold prices keep rising and what it means for investors moving forward.

Read: Why Do Gold Prices Keep Rising? Here Are the Main Factors

Click here to get the latest news updates from Tempo on Google News

Pegadaian Gold Prices Jump, Galeri24 and UBS Surge

10 jam lalu

Gold prices quoted from the official Sahabat Pegadaian website show that two products from Galeri24 and UBS have experienced price increases.

Silver Price Climbs in 2026: Will the Rally Continue?

23 jam lalu

As of January 27, the silver price climbed to US$111.71 per ounce, continuing a strong early-year rally. Will the upward momentum sustain?

Why Do Gold Prices Keep Rising? Here Are the Main Factors

1 hari lalu

Why does the gold price increase during global uncertainty? This guide breaks down the main reasons behind gold's surge and investor demand.

Gold Breaks $5,000: What Fuels the Rally, Where Will It End?

2 hari lalu

Gold continues to hit record highs, having already had a bumper run in 2025.

Gold Prices Predicted to Hit Rp3 Million per Gram by Next Weekend

3 hari lalu

Analyst said that gold prices could surpass Rp3 million per gram by the end of February, provided global prices remain above the US$5,000 mark.

Antam Gold Prices Slide Rp6,000 in Today's Trading

12 hari lalu

The Antam gold price on Saturday, January 17, 2025, is Rp2,663,000 per gram.

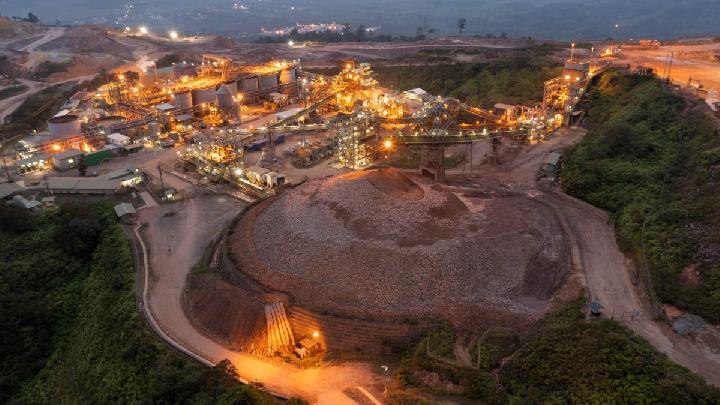

Indonesia's Antam Denies Viral Rumors of West Java Mine Explosion

14 hari lalu

PT Antam Tbk confirmed no explosion at its Pongkor mine in West Java, dismissing viral social media rumors..

Indonesia's Gold Prices Continue Rising Since January 10

14 hari lalu

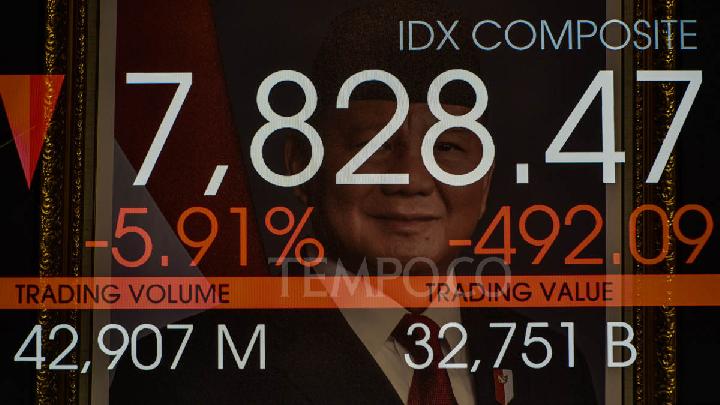

The price of Antam gold in Indonesia rose by Rp10,000 to Rp2,675,000 per gram from Rp2,665,000 previously, supported by a weakening rupiah.

Weakening Rupiah Could Drive Up Gold Prices in Indonesia, Says Analyst

16 hari lalu

The rupiah exchange rate at the end of the week is likely to approach around Rp16,900. This will push the price of precious metals higher.

Indonesia Grants Rp1bn Bonus to SEA Games Gold Medalists

21 hari lalu

Minister of Youth and Sports Erick Thohir mentioned that the medal count at this SEA Games exceeded the initial target of 80 gold medals.