January 29, 2026 | 05:24 pm

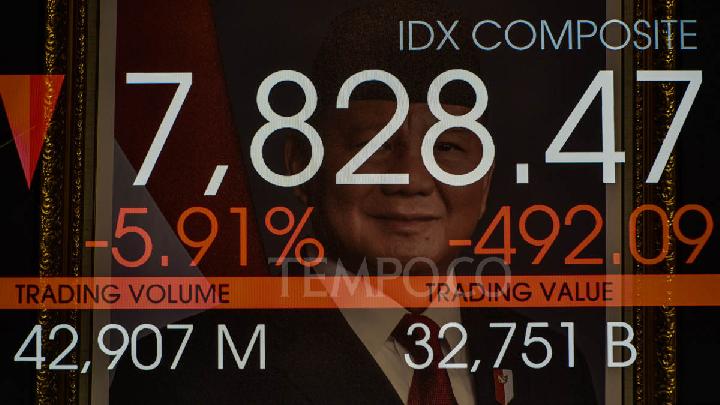

TEMPO.CO, Jakarta - The Chair of the Financial Services Authority (OJK), Mahendra Siregar, stated that he would work at the Indonesia Stock Exchange (IDX) starting tomorrow, Friday, January 30, 2026. This decision comes after Morgan Stanley Capital International (MSCI) temporarily froze the Indonesian stock index rebalancing, causing the Indonesia Composite Index (IHSG) to plummet for two consecutive days.

Mahendra stated that the OJK and the capital market's Self-Regulatory Organization (SRO) are currently focusing on steps to improve the market. He said, "The focus is on reform, entirely for its improvement, and it's progressing quickly, accurately, and effectively. And to ensure that, starting tomorrow, we will also work here," during a press conference at the Indonesia Stock Exchange on Thursday, January 29, 2026.

According to Mahendra, the reform aims to enhance the transparency and integrity of the Indonesian stock market. Thus, the Indonesia Stock Exchange can align itself with international developments and standards.

Mahendra stated that the OJK views the MSCI statement as valuable input. "Because we see that the institution still wants to include shares of Indonesian issuers in the global index, which indicates that the Indonesian stock market is very potential and investable for international investors," he said.

As part of its improvement efforts, IDX will soon issue a regulation requiring a minimum of 15 percent free float. Under the current regulation, the minimum free float of shares is 7.5 percent.

IDX's President Director, Iman Rachman, is also scheduled to meet with MSCI representatives next Monday. "Since a few days ago, we have directly discussed with foreign investors. They requested time from us to explain the steps taken by OJK and SRO," said Iman.

Read: IDX to Require Minimum 15% Free Float

Click here to get the latest news updates from Tempo on Google News

Indonesia's OJK Hands Over Rp161 Billion in Recovered Scam Funds to Victims

7 hari lalu

Indonesia's OJK handed over Rp161 billion in recovered fraud funds to scam victims.

PPATK Detects Signs of Ponzi Scheme in Dana Syariah Indonesia

12 hari lalu

The PPATK said that public funds collected by PT Dana Syariah Indonesia were suspected of being diverted to companies affiliated with the management.

Consumption Dominates 67% of Indonesia's Online Loan Debt

16 hari lalu

OJK noted that the volume of online loan distribution is projected to swell during the upcoming Ramadan period.

Indonesia's Fintech Lending Reaches Rp94.85 Trillion as Default Rate Rises

20 hari lalu

Indonesia's Financial Services Authority said fintech lending reached Rp94.85 trillion in November 2025, even as default risks increased.

Indonesia's OJK Issues New Regulations for Pay Later Services

35 hari lalu

A new regulation by OJK is set to regulate pay later transactions, which can only be carried out by banks and multifinance.

Indonesia's OJK Publishes Whitelist of Licensed Digital Asset, Crypto Traders

39 hari lalu

Indonesia's Financial Services Authority (OJK) has released a whitelist of licensed digital financial asset traders and registered candidates.

OJK Inspects Regional Banks After BI-Fast Cyber Breach

39 hari lalu

The Financial Services Authority (OJK) initiates rapid inspection program for regional development banks after BI-Fast hacking incident.

Indonesia Grants KUR Relaxation for Disaster-Affected Debtors

43 hari lalu

The government provides relief for three years for debtors of the People's Business Credit (KUR) affected by flooding in Aceh, West Sumatra, and North Sumatra.

Indonesia Eyes Rp100 Trillion in Corporate CSR to Support Poverty Reduction

43 hari lalu

BP Taskin urges Indonesian banks and listed companies to use CSR programs for poverty reduction.

Indonesian Online Loan Debt Hits Rp92.92 Trillion

46 hari lalu

The Financial Services Authority (OJK) reported that outstanding debt in the Indonesian online loan industry reached Rp92.92 trillion.