January 29, 2026 | 04:36 pm

TEMPO.CO, Jakarta - Danantara Chief Investment Officer Pandu Sjahrir highlighted the potential risk of Indonesia's stock market being downgraded from an emerging market to a frontier market due to Morgan Stanley Capital International (MSCI)'s decision on free float transparency. According to Pandu, failure to meet MSCI's requirements could result in a downgrade of Indonesia's stock market position.

He emphasized that MSCI's feedback has been clearly communicated, and the next steps depend on the capital market regulator. "I believe that if there are no changes, the IHSG (Indonesia Composite Index) will definitely fall. This is a fact that is happening right in front of us," Pandu said during the Prasasti Economic Forum 2026 at the Ritz Carlton, Jakarta, on Thursday, January 29, 2026.

Regarding Danantara's position, he stated that the investment management body cannot do much and has surrendered it to the regulator. "Danantara focuses on investments. I hand it back to the role of the regulator," he said.

Pandu explained that failing to meet MSCI's requirements could result in a downgrade of Indonesia's stock market. He said that the Indonesian capital market may risk entering the frontier market category. "If it descends to a frontier market, there will be outflows of around US$25 billion to US$50 billion from the Indonesian stock market," Pandu said.

According to Pandu, the regulator needs to act quickly to maintain investor confidence. The capital market is an important indicator that helps global investors assess a country's stability and credibility.

He urged the regulator not to be fixated on the current conditions. Pandu also mentioned the market's excessive response, which triggers consecutive pressures. He emphasized that the main issue lies in the system, not the market players. "Look forward, focus on the future. Never hate the player, hate the game," he said.

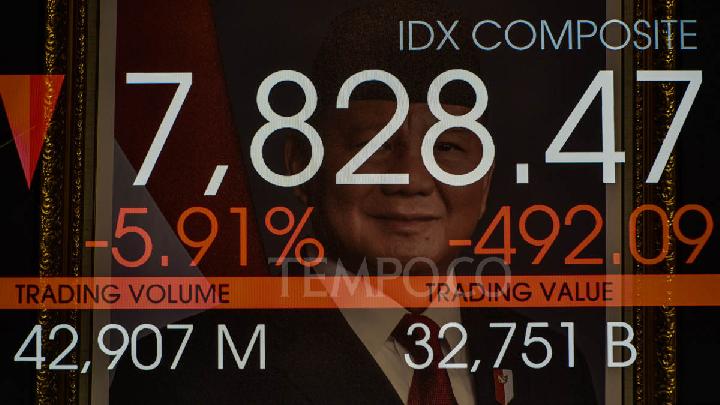

Previously, the Indonesia Stock Exchange (IDX) temporarily halted stock trading on Thursday, January 29, 2026, at 09:26 local time. The suspension occurred after the IHSG dropped 8 percent. "IDX made this effort to ensure that stock trading remains orderly, fair, and efficient," said IDX Corporate Secretary Kuatsar Primadi Nurahmad in an official statement.

The IHSG opened at 8,027.8 and dropped to 7,654.6. At the close of the previous day, the index was at 8,320.5. This was the second consecutive trading halt after trading was temporarily suspended on Wednesday, January 28, 2026, when the IHSG declined by 8 percent to 8,261.78.

Market pressures emerged after MSCI announced the temporary freezing of the Indonesian stock index rebalancing. Capital market observer Reydi Octa viewed that the policy served as the initial trigger. "However, the decline in IHSG that led to the trading halt more reflects short-term emotional reactions and panic selling," said Reydi on Wednesday, January 28, 2026.

Anastasya Levenia contributed to this article

Read: IHSG Plunge: A Turning Point for Capital Market Reform?

Click here to get the latest news updates from Tempo on Google News

IDX to Require Minimum 15% Free Float

1 jam lalu

This adjustment follows MSCI's announcement to temporarily freeze Indonesia stock index rebalancing.

IHSG Plunges 8%, Forcing IDX to Halt Trading Again

6 jam lalu

IDX temporarily halted trading on Thursday, January 29, 2026, at 09:26 Jakarta Automated Trading System (JATS) time.

IHSG Weakens as MSCI Halts Indonesian Stock Index Rebalancing

1 hari lalu

The IHSG opened weaker by 597.75 points, or 6.66%, at 8,382.48, after MSCI temporarily froze the rebalancing of its indexes for Indonesian stocks.

IDX to Discuss Index Rebalancing with MSCI

1 hari lalu

IDX responds after Morgan Stanley Capital International (MSCI) temporarily freezes the rebalancing of Indonesian stocks.

MSCI Freezes Indonesia Stock Index Rebalancing Amid Market Concerns

1 hari lalu

Many investors have expressed concerns about how KSEI categorizes its shareholders.

IHSG Opens Above 9,000 Amid Optimism Over Fed Interest Rate Outlook

15 hari lalu

Indonesia's Composite Stock Price Index (IHSG) opened higher on Wednesday, January 14, 2026, gaining 58.75 points, or 0.66 percent, to 9,007.04.

HSBC's 2026 Outlook: Indonesia's Stock Market Strengthens as Rupiah Weakens

16 hari lalu

HSBC Global Research predicts the Indonesia Composite Index (IHSG) could reach 9,700 this year.

IHSG Needs Solid Economic Fundamentals to Break 10,000

18 hari lalu

OJK highlights the factors affecting the movement of IHSG and expresses optimism about reaching the 10,000 level.

Indonesia's IHSG Closes at All-Time High as Precious Metal Prices Strengthen

22 hari lalu

The IHSG rose 74.41 points, or 0.84 percent, to close at 8,933.61 points.

IDX Trading Schedule for Christmas and New Year Holidays

35 hari lalu

The stock trading will be closed on December 25, 26, and 31, 2025, as well as January 1, 2026.