January 30, 2026 | 12:34 pm

TEMPO.CO, Jakarta - Indonesia Stock Exchange (IDX) Chief Executive Officer Iman Rachman announced his resignation on Friday, January 30, 2026, following a two-day plunge in the benchmark Composite Stock Price Index (IHSG).

Speaking to journalists at the IDX media room in Jakarta, Iman said he was stepping down to take responsibility for the recent turmoil in Indonesia’s capital market.

“As a form of my responsibility for what happened over the past two days, I declare my resignation as Chief Executive Officer of the Indonesia Stock Exchange,” he said.

On Friday morning, the IHSG opened higher, gaining 88.88 points or 1.08 percent to 8,321.08. Iman expressed hope that the rebound would continue in the coming days.

“Hopefully our IHSG, which opened positively this morning, will continue to strengthen,” said Iman, who has served as IDX CEO since 2022.

Below is a timeline of key developments that preceded Iman Rachman’s resignation:

1. MSCI Freezes Indonesian Stock Rebalancing

Morgan Stanley Capital International (MSCI) temporarily froze adjustments to the weightings of major Indonesian stocks in its index on Tuesday night, January 27, 2026.

MSCI cited investor concerns over the transparency of Indonesia’s stock ownership structure.

MSCI warned that if no significant progress is made on transparency issues, it will review Indonesia’s market accessibility status by May 2026. The move raised fears that Indonesia could be downgraded from Emerging Market to Frontier Market status.

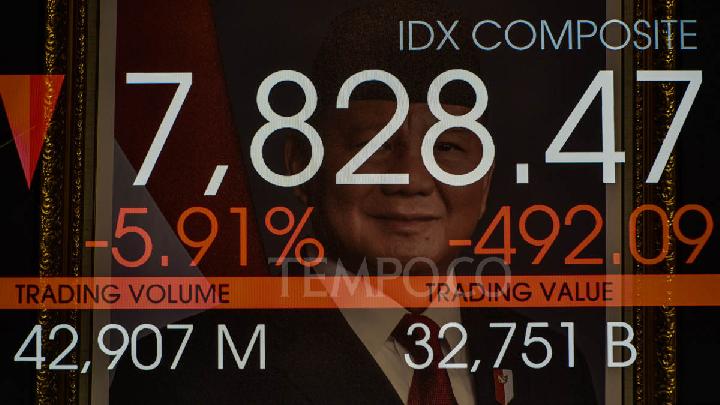

2. IHSG Trading Halted for Two Consecutive Days

The day after MSCI’s announcement, the IHSG plunged sharply, triggering a temporary trading halt on Wednesday afternoon, January 28, 2026. Trading was halted again on Thursday, January 29, 2026, at 09:26 Jakarta Automated Trading System (JATS) time following another steep decline.

Earlier, Coordinating Minister for Economic Affairs Airlangga Hartarto described the market sell-off as a shock reaction from investors. The volatility was largely driven by concerns over a potential downgrade of Indonesia’s stock market following MSCI’s decision.

3. OJK and IDX Announce Capital Market Reforms

In response to the market turmoil, Indonesia’s Financial Services Authority (OJK) and the IDX announced a series of regulatory measures aimed at addressing MSCI’s concerns.

Among the key steps, regulators plan to raise the minimum free float requirement for listed companies to 15 percent, up from the current 7.5 percent. Free float refers to shares available for public trading.

The OJK and IDX also committed to disclosing Ultimate Beneficial Owner (UBO) data, which identifies the actual owners of liquid shares and large-cap stocks included in the IDX100 index, to improve transparency.

OJK Chairman Mahendra Siregar said the regulators had submitted adjustment proposals to MSCI, including readiness to publish share ownership data for corporate and other investor categories holding stakes below five percent.

Following these announcements, the IHSG rebounded on Friday morning, January 30, 2026. However, later the same day, Iman Rachman formally announced his resignation as IDX CEO.

Anastasaya Lavenia contributed to the writing of this article.

Read: IDX President Director Resigns to Take Responsibility

Click here to get the latest news updates from Tempo on Google News

Measures Taken by Indonesia's OJK and IDX After MSCI Decision

2 jam lalu

OJK and IDX take steps in response to MSCI's decision to temporarily freeze the rebalancing of Indonesian stocks composition and weight.

IDX President Director Resigns to Take Responsibility

3 jam lalu

The President Director of the Indonesian Stock Exchange (IDX), Iman Rachman, announced his resignation on Friday, January 30, 2026.

IHSG Edges Lower Following Morning Trading Halt

17 jam lalu

The IHSG closed lower on Thursday despite a mid-morning trading halt triggered by an 8% drop.

OJK Head to Work at IDX to Reform Stock Market

19 jam lalu

OJK and the capital market's Self-Regulatory Organization (SRO) are currently focusing on steps to improve the market.

IHSG Plunge: A Turning Point for Capital Market Reform?

21 jam lalu

The Jakarta Composite Index (IHSG) plummeted 8 percent on Thursday morning, January 29, 2026, prompting the trading halt.

IDX to Require Minimum 15% Free Float

21 jam lalu

This adjustment follows MSCI's announcement to temporarily freeze Indonesia stock index rebalancing.

Purbaya Dismisses IHSG Turmoil as Fundamental Weakness

22 jam lalu

Finance Minister Purbaya Yudhi Sadewa labels the recent IHSG trading halts a temporary market shock.

BCA to Buyback Rp5 Trillion in Shares

1 hari lalu

PT Bank Central Asia (BCA) Tbk will conduct a share buyback of its shares that have been issued and listed on the Indonesia Stock Exchange (IDX).

IHSG Plunges 8%, Forcing IDX to Halt Trading Again

1 hari lalu

IDX temporarily halted trading on Thursday, January 29, 2026, at 09:26 Jakarta Automated Trading System (JATS) time.

IDX Halts Trading After IHSG Plunges 8%

1 hari lalu

The Indonesia Stock Exchange (IDXI) temporarily halts trading after the Indonesia Composite Index (IHSG) fell by 8 percent.