January 30, 2026 | 03:08 pm

TEMPO.CO, Jakarta - Indonesia’s government plans to accelerate the demutualization of the Indonesia Stock Exchange (IDX) following a recent sell-off in the domestic stock market that was triggered by negative sentiment from global index provider Morgan Stanley Capital International (MSCI) and rating downgrades by major financial institutions.

Coordinating Minister for Economic Affairs Airlangga Hartarto said the move is part of a broader structural reform aimed at strengthening Indonesia’s capital market and improving governance at the exchange.

“This is a structural transformation intended to reduce conflicts of interest within the stock exchange, between exchange managers and exchange members, and to prevent unhealthy market practices,” Airlangga said at a press conference at the Danantara Building in Jakarta on Friday, January 30, 2026.

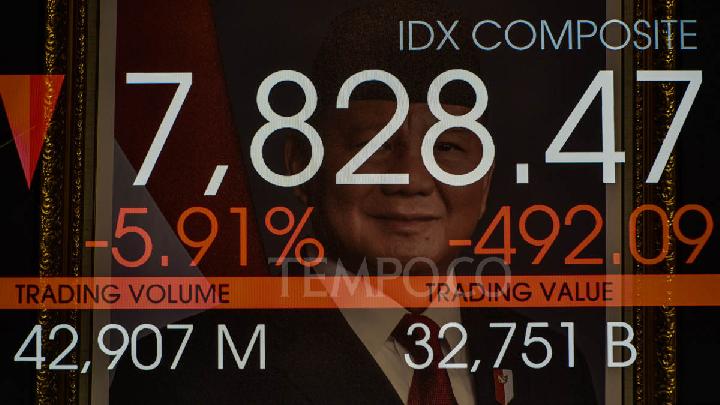

The announcement came after Indonesia’s Composite Stock Price Index (IHSG) declined earlier this week, following MSCI’s critical assessment of the Indonesian market, as well as separate downgrades by UBS Group AG and Goldman Sachs.

Airlangga said the government is considering fast-tracking the demutualization process within this year. Demutualization refers to the conversion of the stock exchange from a member-owned organization into a for-profit company with a clear separation between ownership, management, and trading participants.

According to him, the process would also open new investment opportunities, including potential participation by Indonesia’s sovereign wealth fund (SWF) and other institutional investors.

“The demutualization of the exchange is already mandated under the Financial Sector Development and Strengthening Act,” Airlangga said, referring to the Financial Sector Development and Strengthening Act (FSDSA). “In the next phase, the exchange is expected to move toward becoming a publicly listed company.”

The government has also pledged to reinforce investor protection and improve transparency in the capital market. “The government guarantees protection for all investors by strengthening governance and ensuring transparency of information,” Airlangga added.

Separately, the Financial Services Authority (OJK) has targeted the completion of IDX demutualization by the first half of 2026. However, the draft government regulation (RPP) governing the demutualization process is still under discussion.

MSCI had previously flagged several structural issues in Indonesia’s capital market, including the low free float of listed companies. Free float refers to the proportion of shares available for public trading.

According to MSCI, the average free float in Indonesia remains below 15 percent, a threshold it considers important for market accessibility and liquidity.

MSCI also highlighted concerns over limited transparency in share ownership, warning that these conditions could lead to distorted price formation in the market.

In response, Airlangga said that OJK and the IDX are expected to gradually increase the free float requirement from the current level of around 7.5 percent to 15 percent, in line with MSCI’s expectations.

“This level is actually comparable with practices in several other countries, because Indonesia’s free float has been very low,” he said.

Airlangga compared Indonesia’s situation with regional and global markets. Thailand, he noted, applies a similar minimum free float requirement. Other markets such as Singapore, the Philippines, and the United Kingdom have minimum levels of around 10 percent.

The government hopes that accelerating demutualization and increasing free float levels will restore investor confidence, enhance market credibility, and strengthen Indonesia’s position in global capital markets.

Read: Timeline of Indonesia's IHSG Slump Leading to IDX CEO's Resignation

Click here to get the latest news updates from Tempo on Google News

Timeline of Indonesia's IHSG Slump Leading to IDX CEO's Resignation

2 jam lalu

Recent turmoil in Indonesia's stock market led to the resignation of Indonesia Stock Exchange (IDX) Chief Executive Officer Iman Rachman.

IDX President Director Resigns to Take Responsibility

5 jam lalu

The President Director of the Indonesian Stock Exchange (IDX), Iman Rachman, announced his resignation on Friday, January 30, 2026.

Indonesia's Purbaya Advises Investors to Buy Blue-Chip Stocks as IHSG Plunges

18 jam lalu

Purbaya is confident that the plunge in IHSG triggering trading halt only occurs for 2 to 3 days.

IHSG Edges Lower Following Morning Trading Halt

19 jam lalu

The IHSG closed lower on Thursday despite a mid-morning trading halt triggered by an 8% drop.

Goldman Sachs Downgrades Indonesian Stocks After MSCI Warning

19 jam lalu

The downgrade comes after the announcement by Morgan Stanley Capital International (MSCI) to temporarily freeze the rebalancing of Indonesian stocks.

OJK Head to Work at IDX to Reform Stock Market

21 jam lalu

OJK and the capital market's Self-Regulatory Organization (SRO) are currently focusing on steps to improve the market.

Danantara CIO Warns of Potential Downgrade to Indonesia's Stock Market

22 jam lalu

Danantara CIO Pandu Sjahrir warned about the risk of Indonesia's stock market downgrading following MSCI's decision on free float transparency.

IHSG Plunge: A Turning Point for Capital Market Reform?

23 jam lalu

The Jakarta Composite Index (IHSG) plummeted 8 percent on Thursday morning, January 29, 2026, prompting the trading halt.

IDX to Require Minimum 15% Free Float

23 jam lalu

This adjustment follows MSCI's announcement to temporarily freeze Indonesia stock index rebalancing.

Purbaya Dismisses IHSG Turmoil as Fundamental Weakness

1 hari lalu

Finance Minister Purbaya Yudhi Sadewa labels the recent IHSG trading halts a temporary market shock.