November 1, 2025 | 09:46 pm

TEMPO.CO, Jakarta - Crypto market players are viewing the consolidation of crypto assets after the meeting between US President Trump's and China's Xi Jinping in Busan, South Korea, as a sign that geopolitical factors continue to be the primary driver of market sentiment.

"The current price consolidation reflects the digital market's adaptation mechanism to rapidly changing global macroeconomic conditions," said Indodax Vice President Antony Kusuma in Jakarta on Saturday, November 1, 2025.

According to Antony, crypto assets experience moderate corrections with Bitcoins (BTC) and Ethereum (ETH) each dropping by 1.66 percent and 1.64 percent, resulting in a market capitalization decline of around 0.77 percent.

Antony said investors are no longer just reacting to interest rate figures or monetary policies but are beginning to evaluate the overall context, from geopolitics and institutional capital flows to market psychology.

The correction that occurred after the Fed's announcement is a tangible example of an increasingly rational market behavior.

The tariff deal and the resolution of rare earths issues send positive signals, but the market tends to await actual implementation before reacting significantly.

According to him, wise crypto investors will seize this volatility for accumulation purposes, not just to follow price trends.

Antony stated that crypto investors should view volatility as a strategic opportunity, since digital market differs from traditional markets. Sharp price shifts create moments for investors to optimize their portfolios.

The key is discipline, diversification, and a fundamental understanding of assets. Those who can interpret the global economic context and institutional behavior will be better prepared to face short-term uncertainty while maximizing long-term profit potential.

Antony emphasized the importance of understanding the interaction between monetary policy and the digital market sentiment. "Interest rate cuts and the Trump-Xi Jinping meeting indicate liquidity, but their effects are always relative to real economic conditions and investor expectations," he said.

The combination of the Fed's monetary policy and international trade issues creates pressure on digital assets, while offering opportunities for disciplined investors.

He emphasized that institutional investors demonstrate maturity by leveraging corrections for accumulation, while retail investors are advised to constantly update information, adjust strategies, and conduct independent analysis before making decisions.

Editor’s Choice: Digital Economy Contributes Rp42.5 Trillion to Indonesia's Tax Revenue Over Five Years

Click here to get the latest news updates from Tempo on Google News

Indonesia Promotes IPFO to Finland as Collaboration Expands

3 hari lalu

Indonesian Minister Agus Harimurti Yudhoyono discusses potential collaboration with Finland in renewable energy, water management, and waste.

Indonesia Makes Debut in Yuan Market, Issues 6 Billion Yuan in Dim Sum Bonds

7 hari lalu

The Indonesian government has successfully issued its first-ever State Bonds denominated in Chinese Renminbi (CNH), commonly known as Dim Sum Bonds.

Over 200 Investors Keen to Invest in Indonesia's Waste-to-Energy Project

8 hari lalu

Danantara is currently selecting investors to join the project.

The Risks Behind Danantara's Move to Enter Indonesian Capital Market

8 hari lalu

The plan for Danantara to enter the stock market is not new, as in April, it opened opportunities to become a liquidity provider in the capital market.

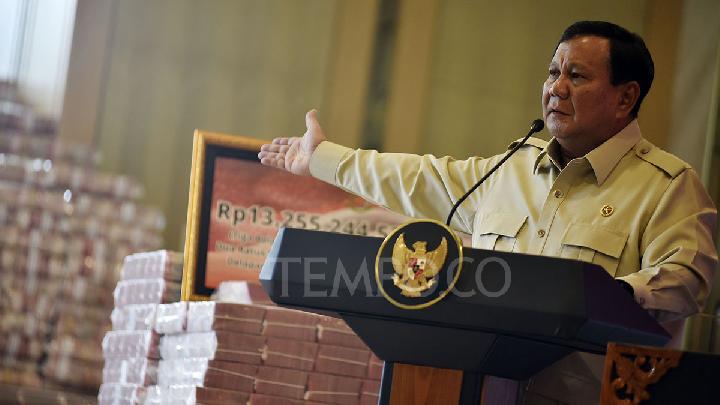

Investor Confidence Falters Under Prabowo's Policies

8 hari lalu

A year into Prabowo Subianto's presidency, fiscal uncertainty persists as investor confidence weakens.

Digital Economy Contributes Rp42.5 Trillion to Indonesia's Tax Revenue Over Five Years

10 hari lalu

The source of the tax revenues includes online lending platforms and crypto.

Indonesia's Purbaya Says Market Fluctuations Benefit Investors

14 hari lalu

Minister of Finance Purbaya Yudhi Sadewa emphasized the importance of a fluctuating stock market to benefit investors.

Tracing Bitcoin Price History: From 2008 Origins to Surpassing $100,000 in 2024

22 hari lalu

Tracing Bitcoin price history, the piece explores its rise from a 2008 innovation to surpassing $100,000 in 2024.

Finance Minister Urges IDX to Strengthen Oversight of Investor Behavior

23 hari lalu

Finance Minister Purbaya Yudhi Sadewa guaranteed that he would comply with the incentives if the IDX was able to improve the capital market conditions

Bitcoin Price Surges Past US$126,000 as Traders See Crypto Market Heating Up

24 hari lalu

The digital currency Bitcoin has once again reached its all-time high at the level of $126,000, approximately approaching Rp2.1 billion per coin.