February 8, 2026 | 09:00 pm

TEMPO.CO, Jakarta - The debt rating agency Moody's has downgraded the outlook for five major banks in Indonesia from stable to negative. The five banks are Bank Mandiri, Bank Rakyat Indonesia (BRI), Bank Negara Indonesia (BNI), Bank Central Asia (BCA), and Bank Tabungan Negara (BTN).

This downgrade is consistent with the change in Indonesia's credit rating outlook from stable to negative.

"This rating change primarily reflects the negative outlook on Indonesia's Baa2 credit rating, which reflects an increased risk to Indonesia's policy credibility, as reflected in the reduced predictability and coherence in the policy-making process, together with less effective policy communication over the past year," Moody's stated in its announcement, quoted on Sunday, February 8, 2026.

Moody's has assessed that if this trend continues, it will erode Indonesia's policy credibility, which has so far supported solid economic growth as well as fiscal, macroeconomic, and financial stability. Furthermore, Moody's stated that the downgrade of Indonesia's credit rating will impact the credit ratings of the five banks.

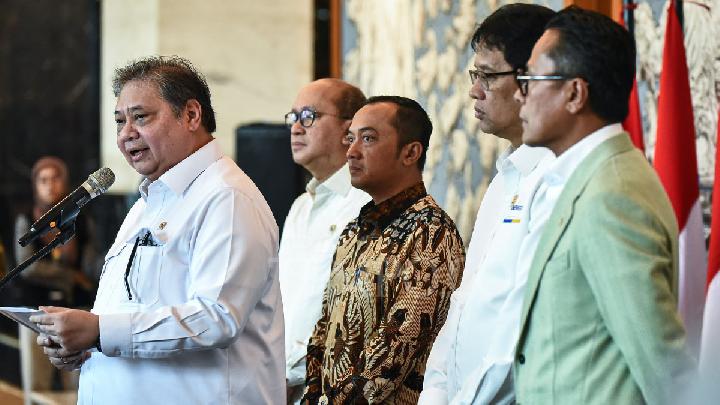

In response to the downgrade of the five banks' outlook, Coordinating Minister for the Economy Airlangga Hartarto has requested the national banking sector to provide open explanations. According to Airlangga, clarifications from each bank are needed to understand the concerns underlying the assessments.

"All rating agencies surely have their own concerns. This needs to be explained, and these concerns also need to be adequately addressed by the banking sector," Airlangga said after attending the APEC Business Council Meeting at the Shangri-La Hotel, Jakarta, on Saturday, February 7, 2026.

Here are Moody's considerations for each bank:

1. Mandiri

Moody's stated that the Baa2 deposit rating and Baa2 Baseline Credit Assessment (BCA) of Mandiri reflect strong capital, solid funding, and high profitability. However, several risks exist, including declining capital, new loans due to rapid credit growth, pressure on asset quality in some segments, and high credit exposure to commodity and high-risk sectors.

Moody's estimates that the Tangible Common Equity (TCE) to Risk Weighted Assets (RWA) ratio will decrease by 14.5 to 15 percent due to high dividends and a 10 percent increase in RWA by 2026. Additionally, the estimated Return on Tangible Equity (ROTE) is 2.2 percent in 2026.

2. BRI

BRI is considered to have strong profitability, sufficient capital, and solid funding. However, Moody's determined that there will be a high level of asset risk in 2026-2027 due to significant exposure to MSME credits. Moody's predicts that BRI's profitability will decrease in 2026.

3. BNI

BNI is deemed to have strong capitalization, moderate liquidity, and a stable funding structure. However, according to Moody's, BNI's profitability decreased due to pressure on Net Interest Margin (NM) during 2025 and is expected to remain moderate. Moody's predicts that ROTA will be around 1.4 to 1.5 in 2026.

4. BCA

According to Moody's, the current BCA rating reflects strong asset quality, high profitability, strong capitalization, and good liquidity. However, the country's rating still limits BCA's financial profile. The bank's ROTA is estimated to decrease to around 3.5 percent in 2026.

5. BTN

Moody's stated that BTN's current rating reflects high asset risk with low reserve levels. This is evident from the high credit restructuring and accrual interest rates. Although Moody's estimates that BTN's profitability will remain stable in 2026, the current level of profitability is expected to be much lower if the bank increases its reserves in line with asset risks.

Nandito Putra contributed to this article

Read: Purbaya Plays Down Moody's Downgrade of Indonesia's Debt Outlook

Click here to get the latest news updates from Tempo on Google News

Stock Market Recap: JCI Weakens 4.73%, Capitalization Falls

2 jam lalu

On Friday afternoon, February 6, 2026, the Jakarta Composite Index (JCI) closed lower at 7,935.26.

Today's Top 3 News: Indonesia Falls to Iran in Dramatic 2026 AFC Futsal Championship Final

3 jam lalu

Here is the list of the top 3 news on Tempo English today.

Danantara Urged to Clarify Indonesia's Fiscal Policy to Moody's

1 hari lalu

Coordinating Economic Affairs Minister has urged Danantara to engage directly with Moody's to clarify Indonesia's fiscal policy direction.

Impact of Moody's Downgrade on Indonesia's Rating Outlook

2 hari lalu

Moody's has downgraded Indonesia's debt outlook to negative over fiscal deficit concerns. Will it impact Indonesia's economy?

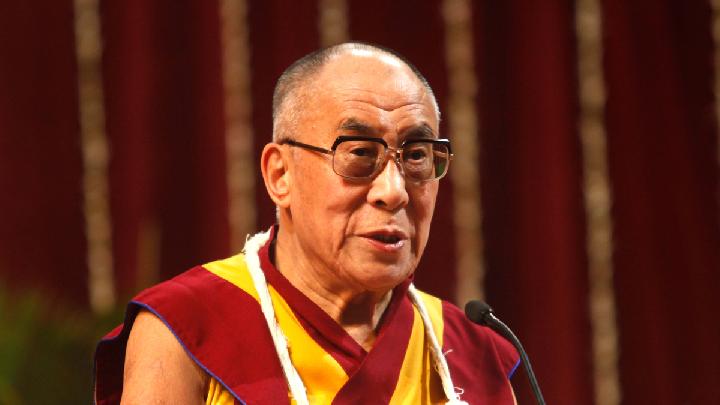

Today's Top 3 News: Dalai Lama Mentioned 169 Times in Recent Epstein Files Releases

2 hari lalu

Here is the list of the top 3 news on Tempo English today.

Purbaya Plays Down Moody's Downgrade of Indonesia's Debt Outlook

2 hari lalu

Moody's revised Indonesia's debt outlook to negative on February 5, 2026, citing fiscal and policy risks, while maintaining the country's Baa2 rating.

OJK Cites Moody's Rating as Proof of Indonesia's Solid Economic Fundamentals

2 hari lalu

The OJK will continue to strengthen its policy synergy with the government and other relevant authorities to maintain financial system stability.

Indonesia's Minister Airlangga Responds to Moody's Rating Downgrade

2 hari lalu

Minister Airlangga Hartarto sheds light on Moody's negative outlook on Indonesia's government debt.

Moody's Downgrades Indonesia Rating Outlook to Negative

2 hari lalu

Moody's on Thursday maintained Indonesia's credit ratings at Baa2, its second-lowest investment grade.

Moody's Cuts Indonesia's Outlook from Stable to Negative

2 hari lalu

Moody's has downgraded Indonesia's debt outlook from stable to negative, citing policy uncertainty and fiscal risks.